How to Estimate Costs Related to Your Property Purchase in Spain

Spain is no different to other countries when it comes to buying a property. In addition to the purchase price, there are associated acquisition costs such as notary fees, stamp duty, registry fees, legal and administration expenses, bank fees, VAT (IVA), Transfer Tax, etc. Here is some basic information (based on 2018 regulations) to help you understand and estimate these related expenses, but we strongly recommend you also obtain professional advice – from legal and financial experts - to clarify and confirm your own individual situation. Also bear in mind that mortgage costs are currently the subject of court action and a government review.

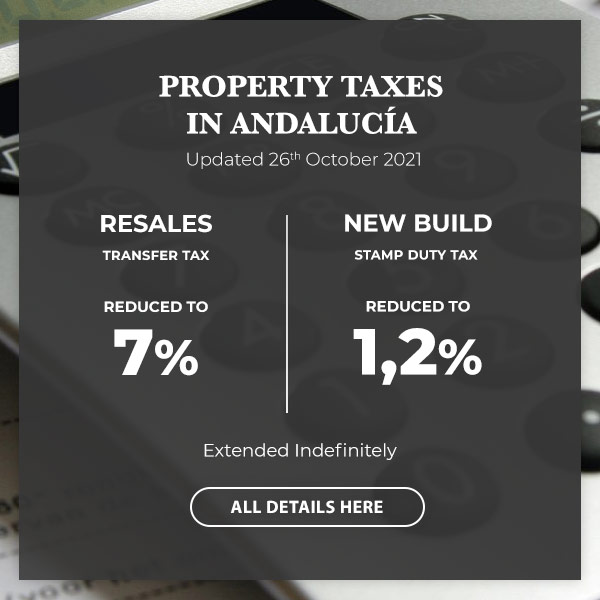

New Property tax updated 2021

Updated 26th October 2021

The Andalusian government has approved a decree that includes a reduction in the Transfer Tax (the tax paid on the purchase and sale of second-hand homes, for example), at present the three rates currently set at 8%, 9% and 10% will now be replaced by a flat rate of 7%. In addition, there will also be a small reduction in Stamp Duty Tax from 1.5% to 1.2%.

Yes, as it sounds, 2021 is a good time to buy a property on the Costa del Sol.

The costs associated with paying these taxes on the purchase of a second-hand property will be significantly reduced.

This new reduction will be available now and extended indefinitely.

Source: BOJA - 26th October 2021. Page 29 & 31.

Property Buying Costs in Spain

Transfer Taxes – Resales

NOW (Updated 27th April 2021)

The Andalusian government reduced the Transfer Tax to a fixed 7% for resale properties. This law was established on 27th April 2021 and is only valid until the 31st December 2021.

BEFORE 27th April 2021

(Calculations based on property value range and applicable rate)

- For dwellings under and up to €400,000, you will pay 8% Transfer Tax.

- Between €400,000 and €700,000, Transfer Tax will be 9%.

- From €700,000 and over, you will need to pay 10% Transfer Tax.

- If you are buying a separate parking space, Transfer Tax will be 8% up to €30,000, 9% for prices between €30,000 and €50,000, and 10% for prices over €50,000.

- If you are fiscally resident and under 35 years old, the Transfer Tax can be reduced to 3.5% if the value of the property is under €130,000.

- For disabled people who are fiscally resident, the Transfer Tax can be reduced to 3.5% up to a maximum property value of €180,000.

- For real estate professionals and companies, the Transfer Tax is 2%.

You can read more about this new update in our Blog Post here:

Find your new home in sunny Spain! Properties for sale on the Costa del Sol

Property Buying Costs in Spain

Taxes on New Properties

NOW (Updated 27th April 2021)

- If you are buying a new property directly from the developer, you will pay VAT (instead of Transfer Tax) at a rate of 10%. In addition you will pay stamp duty at 1.2% until 31st of December 2021, before it was 1.5%.

- For buyers younger than 35 and disabled people, who are fiscally resident, the stamp duty is reduced to 0.3%.

- For parking spaces (acquired separately from the dwelling), VAT is 21% and stamp duty is 1.2% the same as for New Properties, valid until 31st of December 2021, before it was 1.5%.

Total Property Buying Costs in Spain

NOW (Updated 27th April 2021)

As an example, for a purchase price of €250,000...

New property purchase costs: 14.2%

(These include: VAT/IVA at 10%, stamp duty at 1.2%, legal fees 1%, notary and registry fees 1%, plus 0.7% for various documents required such as power of attorney, NIE application and certificates.)

With new mortgage: 16.7%

(These include, in addition to the aforementioned 14.2%, 0.8% notary fees, 0.7% for bank gestor, valuation and provision of funds, and 1% opening fee.)

Please note that the mortgage will require a separate deed but, in accordance with a new regulation, the bank will bear the cost of the tax from now on.

Resale purchase costs: 10.7%

(These include: 7% for Transfer Tax, 1% for legal fees, 1% for notary fees and 0.7% for various documents such as power of attorney, NIE application and certificates.)

With new mortgage (60% of €250,000 or the amount of €150,000): 13.2%

(These include: 10.7% as above plus 0.8% notary fees, 0.7% for bank gestor, valuation and provision of funds).

Still have doubts and questions about tax and other financial costs related to your property purchase in Spain?

Wilt U uw Spaanse droomhuis vinden?

benl

benl

Vlaams-Nederlands

Vlaams-Nederlands